There was a time when trading was a headache. Not anymore! You don't have to study or monitor the market to make a good pick, because hundreds of industry well-known experts from all over the world are doing it for you. All you have to do is pick the experts you like, and Zulutrade will quickly convert their advice into live trades in your trading account directly with the broker. And the best of all, it's completely FREE!

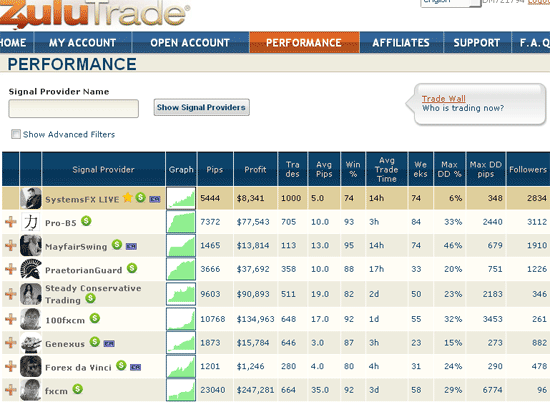

This is probably one of the most important aspects to Zulutrade is picking a Signal Provider to trade for you. From the statistics provided by the site there is over 1,200 traders to pick from.

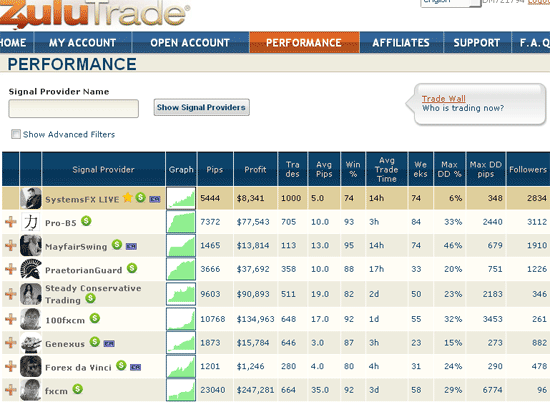

performance statistics

Zulutrade has made life a little easier by providing detailed performance statistics.

1. Signal Provider - is the name of the 3rd party expert signal provider

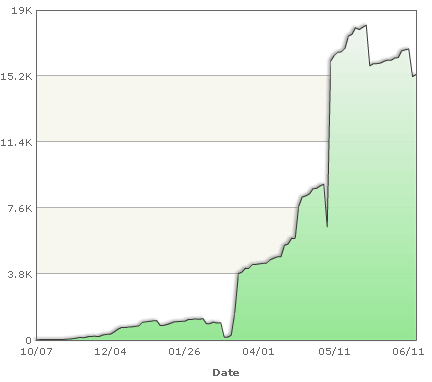

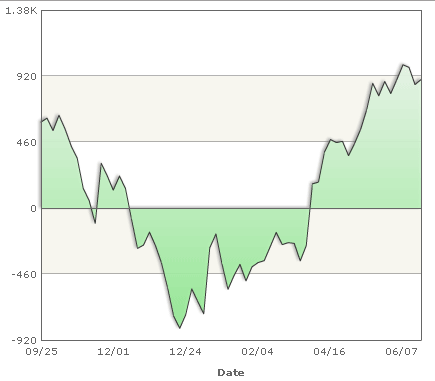

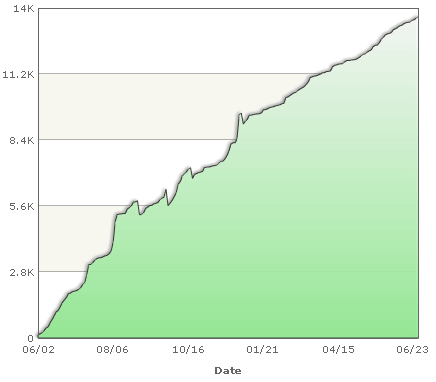

2. Graph - shows the history of accumulated pips. You can select different time frames to display results, from 3 days up to 2 years. This a great visual indicator for when you are scrolling through the different providers, you want to pick one with a consistent upwards trend.

3. Pips - is the total amount of pips that the signal providers has made.

A pip is the minimum movement of a currency upwards or downwards. To calculate each pip for every currency, divide 1/ (currency pair exchange rate) Ex: 1/224.92 (GBP/JPY) = 0.00444 GBP. If you’re trading a 100:1 leverage account, then multiply this with 100. Ex 0.00444 x 1000 = 4.44 GBP. To transform this to USD just convert it. Ex: GBP/USD = 1.9377 x 4.444 = 8.6 USD / pip

Another example is to calculate a pip for GBP/USD. 1/1.9377 = 0.516 GBP. For a 100:1 standard account, multiply that with 10. Ex: 0.516 x 10 = 5.16. To convert in USD multiply with 1.9377. Ex: 5.16 x 1.9377 = 9.98 USD / pip

4. Profit - is the total amount of money in dollars that the signal provider has made

5. Trades - is the total amount of currency trades that the signal provider has made since they have been a memeber on Zulutrade

6. Avg Pips - is how many pips they make on average per trade

7. Win % - out of their trades this is how many were successful, which mean that they are in positives for pips

8. Avg Trade (hrs) - this is the average length in hours that open trades last for.

9. Weeks - how many weeks the signal provider has been trading on Zulutrade

10. Max DD pips - this is the biggest drawdown that the signal provider has experienced in their history of trading on Zulutrade. I find that the smaller the better, other your equity is in danger if there is a big drawdown.

11. Users - this is how many registered users are using this signal provider to trade for them

Before choosing a provider:

Before we get into choosing a provider we need to have a good understanding of what a third party signal provider is. A signal provider is a trader or analyst that generates trades that in turn get placed on your account. You can have several signal providers trading your forex account or just one.

All of these performance indicators play a big part in the decision, there is not just one component to consider when picking a provider. You have to take everything into consideration including their profile and description that they provide. This will detail their trading strategy that they use. To get a good feel for how this all works is to have a good look around and analysis individual signal providers.

Another excellent feature is that you have sort by any of the headings at the top, all you have to do is click on one of them. For example if you would like to see who has the most user you would click on the Users heading.

Like anything else, all third party signal providers are not created equal. At first glance a trader may look like a home run. That same trader may well end up completely torpedoing your entire account in one afternoon. To help make sure this doesn’t happen we’ll set down a few guidelines. These guidelines will give us something to look for when choosing our third party signal provider.

1- Choose A Winner - This may seem obvious to everyone but it goes a bit more in depth than first glance may imply. Not only will you look at profit in both pips and actual dollars, but you should also take a look at pips per trade and how many trades that system generates per week. If one system generates 10 pips per trade but only makes 3 trades a week you average 30 pips per week. You may have another system that generates only 6 pips per trade but generates 25 trades per week. With this system you make 150 pips per week. All things to consider.

2- Choose A Trader That Is Established - I often see traders with only a week or 2 of history and they have 20 or 30 people trading their signals. Generally less than a month later these traders are deep in the red and their 20 or 30 investors have moved on to the next signal. Remember that anyone can go on a run for a week or two. Make sure that you have someone who has proven themselves for at least a couple of months trading your account.

3- Check The Max Draw Down - A really big draw down often equates to a trader that cannot cut his losses. Since he isn't trading with real money he can leave a trade open until it turns a profit. That will often lead to a good trading record on paper but in actuality it will make you(the investor) go broke.

This is the largest peak to trough draw down in equity that the trader has historically had. Some traders refuse to take a loss. This causes them to hold on to losing trades forever or until they turn to a winner. Turning a loser into a winner sounds great, but it will eat up a huge chunk of margin and may never turn around. If it doesn’t turn in your direction, you will have your entire account destroyed by a trader that could have taken a 30 pip loss but held on until it was an 800 pip loss.

4- Look At The Actual Trades - Once you narrow it down to a few traders its time to look at their actual trading history.Some traders have a great track record and have made a lot of money in a short amount of time. The first thing I look for is if they are opening the same trade over and over. ie. Some traders will go buy 1 lot of EUR/USD 25 seperate times at once.

This means that if the trade goes in their favor, all of a sudden they have 25 winning trades in a row. It causes their results to be skewed and makes them look a lot better than they are at first glance. If you are trading a signal provider like this you will often find yourself getting margin calls as well as he continues to open trade after trade and never closes the previous ones.

5- Make Your Own Decision - Just because a signal provider has hundreds of people trading his or her signal does not make them a great choice for you. Do your own homework and decide which system is best for you.

6. Choose a signal provider that suits you - Some traders may provide larger returns over time, but take bigger risks leading to bigger draw downs. This might be OK with you. If you are more conservative and cannot stomach large drops in equity you probably should choose a more conservative trader.

These are just a few things to look for when choosing a third party signal provider to trade your forex account. You should always trade a demo account before opening a live account with real money. Remember it’s your account. In the end you choose the signal providers, and you are responsible for what happens.

If you haven't yet signed up for a FREE demo account Click Here.